Foreign Account Tax Compliance Act (FATCA)

The Foreign Account Tax Compliance Act (FATCA) is a new U.S. tax law whose objective is to reduce or eliminate U.S. tax evasion by U.S. taxpayers who maintain financial accounts outside the United States or invest offshore through non-U.S. entities. This new law impacts all non-U.S. organizations, including sovereign governments, any integral part thereof, their agencies or instrumentalities, and any wholly-owned entities. This section of the site will introduce you to FATCA and help you furnish the appropriate U.S. tax documentation, even if you have not previously needed to furnish any tax certification to Citi.

Important Information

-

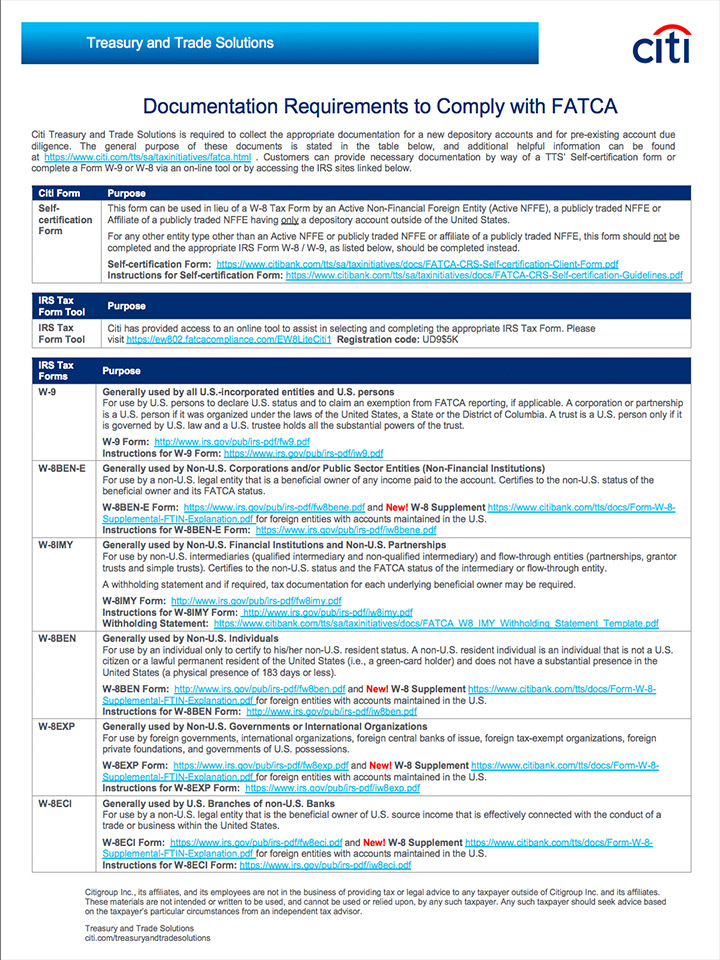

To help our clients complete the appropriate IRS Tax Form, Citi has provided access to an online tool which is available by clicking the button below and entering registration code UD9$5K

-

The most recent FATCA forms can be accessed by using Choosing the Right U.S Tax Form

-

Citi has developed a combined FATCA/CRS self-certification that can be submitted in lieu of a Form W-8 for non-US entities.

-

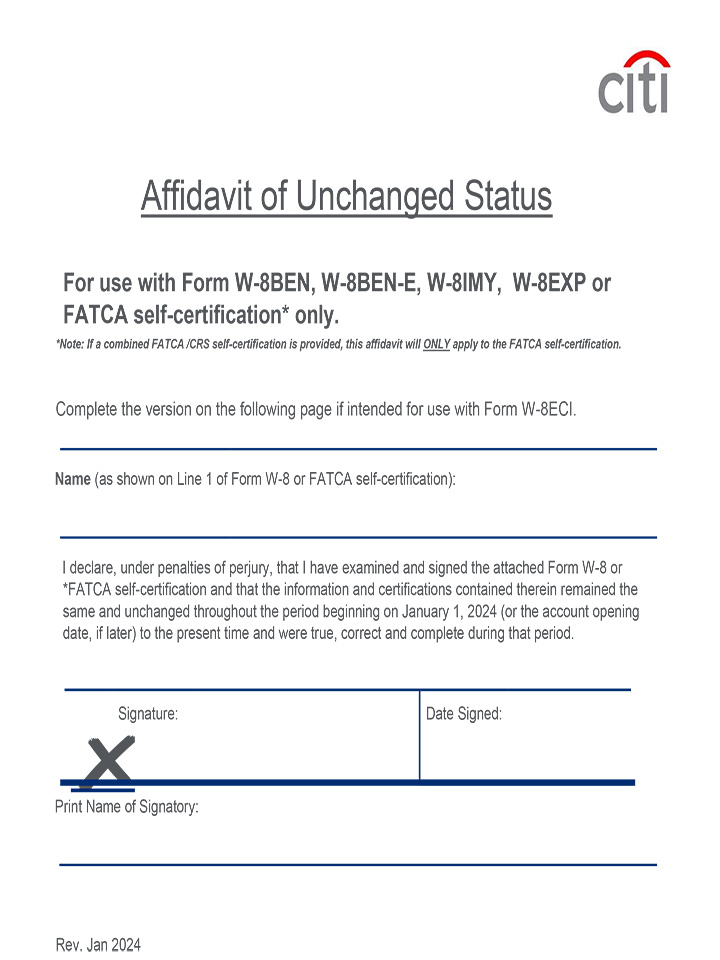

In order to receive a refund of interest withheld during the current calendar year due to the fact that TTS did not have a valid IRS Tax Form W-8 or W-9 on file, please submit Affidavit of Unchanged Status along with your IRS Tax Form to the email address indicated on our FATCA Country Contact site.

-

For refunds for prior years, please access the IRS form 1120-F and instructions for submission to the IRS.

-

For comprehensive information on how you may be affected by FATCA, please reference our FAQs - FATCA Impact on Undocumented Accounts.

Translated FATCA Tax Form Information

We offer the FATCA translated tax forms and instructions; in several languages to help our clients in completing the English versions. Please note the English version of these forms must be submitted in order for them to be accepted and validated.