FATCA/CRS Certification Form

-

Citi has made a combined FATCA/CRS Self-Certification form available to make the documentation process easier for clients. This form can be used in all countries except Japan, Russia and India.

- For translated versions of the form, please see here

- For accounts in Japan, Russia and India, please see here

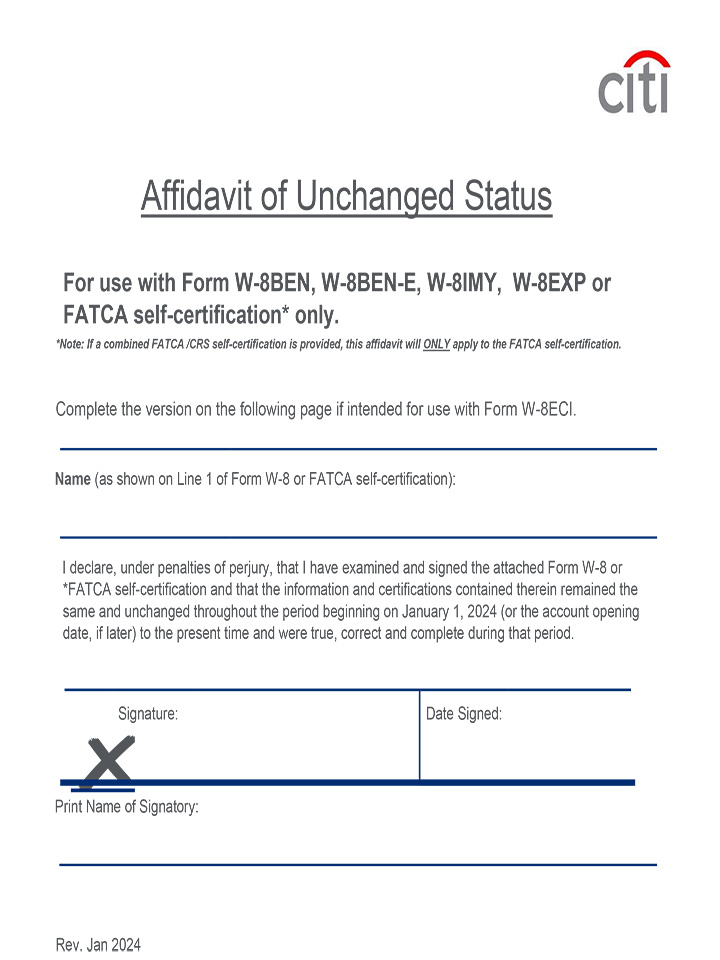

- In order to receive a refund of interest withheld during the current calendar year due to the fact that TTS did not have a valid IRS Tax Form W-8 or W-9 on file, please submit Affidavit of Unchanged Status along with your IRS Tax Form to the email address indicated on our FATCA Country Contact site.

- For refunds for prior years, please access the IRS form 1120-F and instructions for submission to the IRS.

- For comprehensive information on how you may be affected by FATCA, please reference our FAQs - FATCA Impact on Undocumented Accounts.